Latest Version

Version

24.11.0

24.11.0

Update

December 02, 2024

December 02, 2024

Developer

Stride Health

Stride Health

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.stridehealth.drive

com.stridehealth.drive

Report

Report a Problem

Report a Problem

More About Stride: Mileage & Tax Tracker

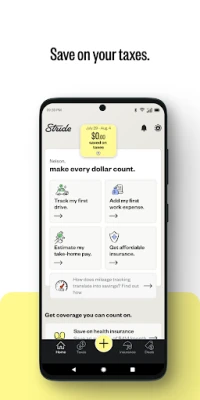

Track miles & mileage automatically. Get affordable insurance. Save on everyday expenses. Simplify taxes. File stress free.

Save an average of $710/year on taxes by using Stride! All for free with no hidden fees.

Join 2,600,000 people saving – for FREE.

HIGHLIGHTS

+ Save big on taxes

+ Automatically track and calculate miles, distance, and trips

+ Log & track daily bills & expenses like phone, gas, and transportation

+ File taxes as self-employed stress-free

+ Find hundreds of tax deductions & write-offs

+ Get affordable insurance (health, life, dental, vision, & more)

REVIEWED BY THOUSANDS

+ I've been doing "gig" driving for just a couple months now, pretty much full time & it's already recorded about $1,300 worth of deductions!

+ “Stride literally has been the difference between me owing and getting money back, 4 years in a row.“

+ “Stride is exceptional! I have been with them for 8 years as a Postmates and Uber Eats driver and I love the mileage tracker.”

+ “BEST app ever for tracking mileage and taxes for my two sources of income, photography and Shipt! I used to write it manually because NONE of the other apps did what I needed them to.”

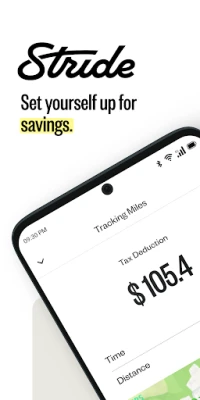

MAXIMIZE MILEAGE DEDUCTIONS

Built & designed for freelancers, gig workers, rideshare drivers, and more. Stride’s mileage tracker helps you discover business expenses you can claim as self-employed and makes filing a breeze.

Stride’s mileage tracker will automatically maximize your mileage deductions and capture them in an IRS-ready standard mileage log format. Stride’s mileage expense tracker gets users $670 back for every 1,000 miles they drive!

+ Automated GPS mileage tracking

+ Set notifications for mileage tracking reminders

+ IRS-ready mileage logs

+ Track & manage your bills

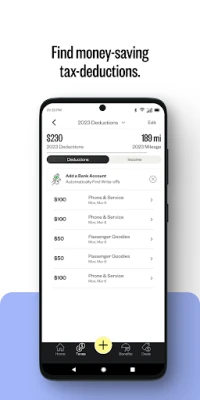

DISCOVER HUNDREDS OF WRITE-OFFS

We find all the expenses and deductions based on all the work you do as someone self-employed. On average, Stride finds users $200 worth of write-offs each week.

+ Discover what expenses you can deduct and how to best track

+ Bank integration to easily import expenses

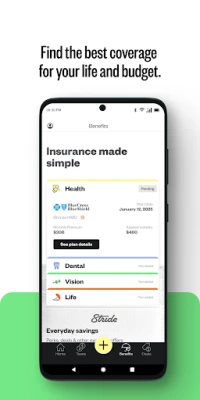

EASILY FIND AFFORDABLE INSURANCE

Find a plan that fits your life and budget. Discover affordable health insurance for less than $10/mo. Stride also offers:

+ Health insurance

+ Vision insurance

+ Life insurance

+ Dental insurance

Get the best plan at the lowest price. Stride users save an average of $447/mo. on health insurance!

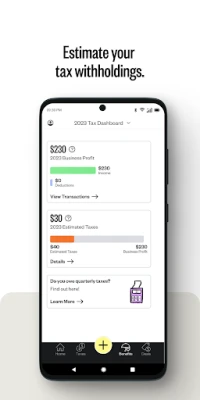

IRS-READY TAX REPORTS

We prepare everything you need to file in IRS-Ready reports for easy filing. Stride’s mileage and expense tracker users cut their tax bill in half on average (56%).

+ Gather all the information needed to file in an IRS-ready report

+ Support with all filing methods: e-file, tax filing software, accountant

+ Have all the information you need to audit-proof your taxes

FIling as self-employed doesn’t have to be stressful!

TRACK YOUR INCOME

Stride is perfect for any independent worker:

+ Rideshare drivers (Uber, Lyft, Curb, etc.)

+ Delivery drivers (DoorDash, Grubhub, Postmates, etc.)

+ Truckers

+ Freelancers, self-employed workers, gig workers, individuals with side hustles, etc.

+ Entertainers

+ Creative professionals

+ Food service professionals

+ Business consultants

+ Sales agents

+ Real estate agents

+ Home service professionals

+ Medical professionals

+ Cleaners

+ And many more!

Join 2,600,000 people saving – for FREE.

HIGHLIGHTS

+ Save big on taxes

+ Automatically track and calculate miles, distance, and trips

+ Log & track daily bills & expenses like phone, gas, and transportation

+ File taxes as self-employed stress-free

+ Find hundreds of tax deductions & write-offs

+ Get affordable insurance (health, life, dental, vision, & more)

REVIEWED BY THOUSANDS

+ I've been doing "gig" driving for just a couple months now, pretty much full time & it's already recorded about $1,300 worth of deductions!

+ “Stride literally has been the difference between me owing and getting money back, 4 years in a row.“

+ “Stride is exceptional! I have been with them for 8 years as a Postmates and Uber Eats driver and I love the mileage tracker.”

+ “BEST app ever for tracking mileage and taxes for my two sources of income, photography and Shipt! I used to write it manually because NONE of the other apps did what I needed them to.”

MAXIMIZE MILEAGE DEDUCTIONS

Built & designed for freelancers, gig workers, rideshare drivers, and more. Stride’s mileage tracker helps you discover business expenses you can claim as self-employed and makes filing a breeze.

Stride’s mileage tracker will automatically maximize your mileage deductions and capture them in an IRS-ready standard mileage log format. Stride’s mileage expense tracker gets users $670 back for every 1,000 miles they drive!

+ Automated GPS mileage tracking

+ Set notifications for mileage tracking reminders

+ IRS-ready mileage logs

+ Track & manage your bills

DISCOVER HUNDREDS OF WRITE-OFFS

We find all the expenses and deductions based on all the work you do as someone self-employed. On average, Stride finds users $200 worth of write-offs each week.

+ Discover what expenses you can deduct and how to best track

+ Bank integration to easily import expenses

EASILY FIND AFFORDABLE INSURANCE

Find a plan that fits your life and budget. Discover affordable health insurance for less than $10/mo. Stride also offers:

+ Health insurance

+ Vision insurance

+ Life insurance

+ Dental insurance

Get the best plan at the lowest price. Stride users save an average of $447/mo. on health insurance!

IRS-READY TAX REPORTS

We prepare everything you need to file in IRS-Ready reports for easy filing. Stride’s mileage and expense tracker users cut their tax bill in half on average (56%).

+ Gather all the information needed to file in an IRS-ready report

+ Support with all filing methods: e-file, tax filing software, accountant

+ Have all the information you need to audit-proof your taxes

FIling as self-employed doesn’t have to be stressful!

TRACK YOUR INCOME

Stride is perfect for any independent worker:

+ Rideshare drivers (Uber, Lyft, Curb, etc.)

+ Delivery drivers (DoorDash, Grubhub, Postmates, etc.)

+ Truckers

+ Freelancers, self-employed workers, gig workers, individuals with side hustles, etc.

+ Entertainers

+ Creative professionals

+ Food service professionals

+ Business consultants

+ Sales agents

+ Real estate agents

+ Home service professionals

+ Medical professionals

+ Cleaners

+ And many more!

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

MoMo PSB NGMTN Nigeria Communications Plc

Text Free: Call & Texting AppPinger, Inc

Chipper CashCritical Ideas, Inc.

WeverseWEVERSE COMPANY Inc.

C-RAM CIWS simulatorAnti Air Gun, Air Defense Game

Freestyle Motocross Skill 3DTop Dirt bike Motocross 3D

Now Thats TVNow Thats TV LLC

Talkatone: Texting & CallingTalkatone, Llc

Zombeast: Zombie ShooterSurvive the Zombie Apocalypse!

JazzCash - Your Mobile AccountJazzCash