Latest Version

Version

2.10

2.10

Update

February 21, 2026

February 21, 2026

Developer

Darshan University

Darshan University

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.aswdc_incometaxcalculator

com.aswdc_incometaxcalculator

Report

Report a Problem

Report a Problem

More About Income Tax Calculator

Latest: Income Tax Calculator for the financial year, FY 2020-21.

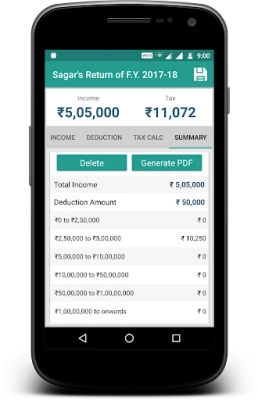

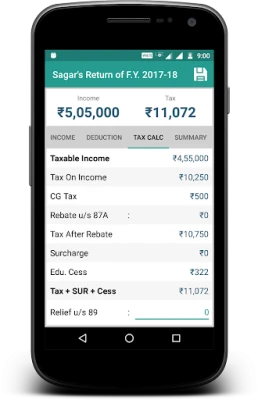

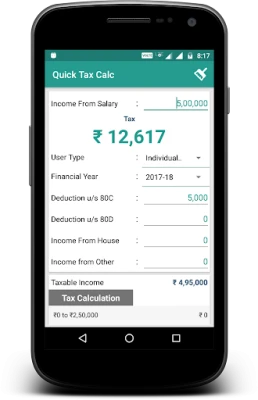

Income Tax Calculator is an app that helps you calculate the payable tax for the income you earned. Income tax slab is shown in the app for Individual Male, Female, Senior Citizen, and Super senior citizen. Tax preparation is very easy using this Income Tax calculation app. It provides you with free tax preparation help. You just need to enter all of your income and the deductions. The app will tell you the payable tax amount. Online Income Tax Return Filling will be so easy using this app. A taxable Income calculator app helps you keep a record summary, and you can share it via email or other social media applications.

Disclaimer (Non‑government / Non‑affiliated):

Income Tax Calculator is an independent application and is not affiliated with, endorsed by, or representing any government entity, including the Income Tax Department, Government of India.

For official information and e‑filing, please use the official portal: https://www.incometax.gov.in/

Official Sources:

Income Tax Department portal: https://www.incometax.gov.in/

e‑Filing portal: https://www.incometax.gov.in/iec/foportal/

Key Features of this app are:

» Quick Tax Calculation: The app provides the quickest way for tax computation.

» Compare Return: Select two different Assessment Year and compare your IT return for 2 years.

» IT Return:

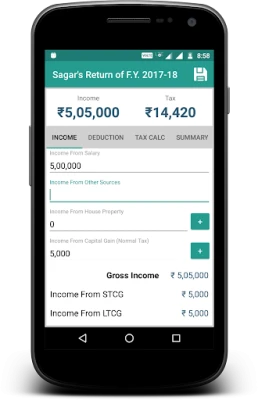

You can plan your saving for the following income source:

√ Income from Salary

√ Income from Other Sources

√ Income from self-occupied house property

√ Long Term Capital Gains (LTCG)

√ Short Term Capital Gains (STCG)

√ Income from Interests

√ Income from Commissions

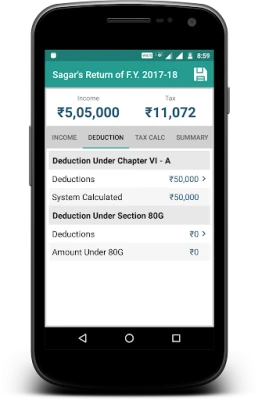

Income tax calculation formula will consider the following parameters for deductions while calculating IT Return:

√ Deduction under 80C (Investment in PPF, NSC, Life insurance Premium, etc.)

√ Deduction under 80D (Investment under Medical Insurance)

√ Deduction under 80DD (Investment for Medical treatment)

√ Deduction under 80EE (Interest on home loan for first-time homeowners)

√ Deduction under 80TTA (deduction to an individual or a Hindu undivided family in respect of interest received on deposits)

» Calculates Income Tax payable for Financial Year 2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16.

» A standard deduction of Rs. 50,000 for salaried taxpayers for the Financial Year 2019-20 is updated.

» Find the tax payable with and without standard deduction of Rs. 50, 000 for the salaried taxpayers for the Financial Year 2020-21.

» Share It: The result in the form of PDF or image can be shared with family members or your Income Tax Consultant or Chartered Accountant.

--------------------------------------------------------------------------------------------------------------------------------

This App is developed at ASWDC by Sagar Makwana (140543107020), a 7th Sem CE Student. ASWDC is Apps, Software, and Website Development Center @ Darshan University, Rajkot run by students & staff of Computer Science and Engineering Department.

Call us: +91-97277-47317

Write to us: aswdc@darshan.ac.in

Visit: http://www.aswdc.in http://www.darshan.ac.in

Follow us on Facebook: https://www.facebook.com/DarshanUniversity

Follows us on Twitter: https://twitter.com/darshanuniv

Follows us on Instagram: https://www.instagram.com/darshanuniversity/

Disclaimer (Non‑government / Non‑affiliated):

Income Tax Calculator is an independent application and is not affiliated with, endorsed by, or representing any government entity, including the Income Tax Department, Government of India.

For official information and e‑filing, please use the official portal: https://www.incometax.gov.in/

Official Sources:

Income Tax Department portal: https://www.incometax.gov.in/

e‑Filing portal: https://www.incometax.gov.in/iec/foportal/

Key Features of this app are:

» Quick Tax Calculation: The app provides the quickest way for tax computation.

» Compare Return: Select two different Assessment Year and compare your IT return for 2 years.

» IT Return:

You can plan your saving for the following income source:

√ Income from Salary

√ Income from Other Sources

√ Income from self-occupied house property

√ Long Term Capital Gains (LTCG)

√ Short Term Capital Gains (STCG)

√ Income from Interests

√ Income from Commissions

Income tax calculation formula will consider the following parameters for deductions while calculating IT Return:

√ Deduction under 80C (Investment in PPF, NSC, Life insurance Premium, etc.)

√ Deduction under 80D (Investment under Medical Insurance)

√ Deduction under 80DD (Investment for Medical treatment)

√ Deduction under 80EE (Interest on home loan for first-time homeowners)

√ Deduction under 80TTA (deduction to an individual or a Hindu undivided family in respect of interest received on deposits)

» Calculates Income Tax payable for Financial Year 2020-21, 2019-20, 2018-19, 2017-18, 2016-17, 2015-16.

» A standard deduction of Rs. 50,000 for salaried taxpayers for the Financial Year 2019-20 is updated.

» Find the tax payable with and without standard deduction of Rs. 50, 000 for the salaried taxpayers for the Financial Year 2020-21.

» Share It: The result in the form of PDF or image can be shared with family members or your Income Tax Consultant or Chartered Accountant.

--------------------------------------------------------------------------------------------------------------------------------

This App is developed at ASWDC by Sagar Makwana (140543107020), a 7th Sem CE Student. ASWDC is Apps, Software, and Website Development Center @ Darshan University, Rajkot run by students & staff of Computer Science and Engineering Department.

Call us: +91-97277-47317

Write to us: aswdc@darshan.ac.in

Visit: http://www.aswdc.in http://www.darshan.ac.in

Follow us on Facebook: https://www.facebook.com/DarshanUniversity

Follows us on Twitter: https://twitter.com/darshanuniv

Follows us on Instagram: https://www.instagram.com/darshanuniversity/

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

MoMo PSB NGMTN Nigeria Communications Plc

Text Free: Call & Texting AppPinger, Inc

Chipper CashCritical Ideas, Inc.

WeverseWEVERSE COMPANY Inc.

C-RAM CIWS simulatorAnti Air Gun, Air Defense Game

Freestyle Motocross Skill 3DTop Dirt bike Motocross 3D

Now Thats TVNow Thats TV LLC

Talkatone: Texting & CallingTalkatone, Llc

Zombeast: Zombie ShooterSurvive the Zombie Apocalypse!

JazzCash - Your Mobile AccountJazzCash