Latest Version

Version

6.0.34

6.0.34

Update

October 30, 2024

October 30, 2024

Developer

Australian Taxation Office

Australian Taxation Office

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

au.gov.ato.ATOTax

au.gov.ato.ATOTax

Report

Report a Problem

Report a Problem

More About Australian Taxation Office

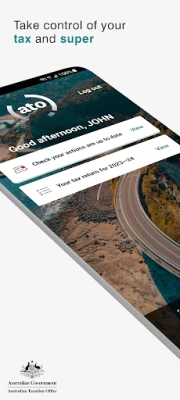

The ATO app allows you to manage your tax and super affairs on the go – making tax simple & easy.

A myGov account linked to the ATO is required for a personalised tax and super experience.

With the ATO app, you can:

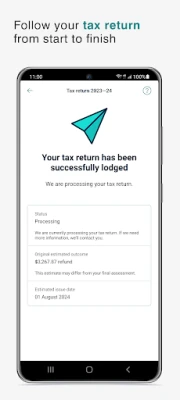

- follow your 2023-24 tax return from start to finish, including checking prefill information, tracking the progress of your return and its outcome

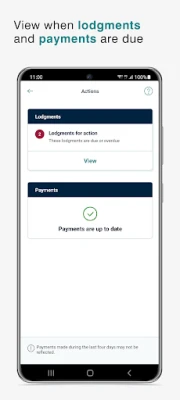

- view in real-time when lodgments and payments are due, and seamlessly action them via ATO Online

- set up streamlined and secure login using your device’s security features like face and fingerprint recognition

- view your tax accounts, with links to ATO Online to view transactions, create payment plans or pay

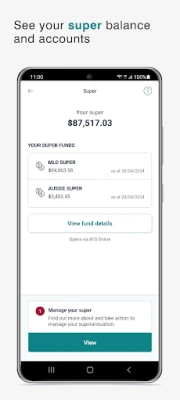

- see an overview of your super balance and accounts

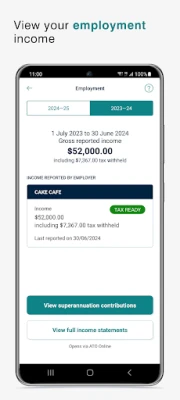

- view your employment income and superannuation contributions required from your employers

- check your personal, business (sole traders only) and registered agent’s details

- access our most popular tools.

Our most popular tools include:

- myDeductions: record your work expenses as an employee or sole trader. Sole traders can also record income. At tax time you can easily upload your myDeductions records to your tax return or email a copy to your tax agent.

- Tax withheld calculator: calculate the amount of tax to withhold from salary and wage payments.

- ABN Lookup: search for an Australian business number (ABN).

- Business performance check: compare your business with similar businesses in your industry using the latest Small business benchmarks.

The ATO app can automatically send usage data to help improve the app. The data we collect doesn’t identify you and you can choose to turn this off at any time in your app’s settings.

GPS can be used to record trips in myDeductions. Continued use of GPS running in the background can dramatically decrease battery life.

Find out more at www.ato.gov.au/app

With the ATO app, you can:

- follow your 2023-24 tax return from start to finish, including checking prefill information, tracking the progress of your return and its outcome

- view in real-time when lodgments and payments are due, and seamlessly action them via ATO Online

- set up streamlined and secure login using your device’s security features like face and fingerprint recognition

- view your tax accounts, with links to ATO Online to view transactions, create payment plans or pay

- see an overview of your super balance and accounts

- view your employment income and superannuation contributions required from your employers

- check your personal, business (sole traders only) and registered agent’s details

- access our most popular tools.

Our most popular tools include:

- myDeductions: record your work expenses as an employee or sole trader. Sole traders can also record income. At tax time you can easily upload your myDeductions records to your tax return or email a copy to your tax agent.

- Tax withheld calculator: calculate the amount of tax to withhold from salary and wage payments.

- ABN Lookup: search for an Australian business number (ABN).

- Business performance check: compare your business with similar businesses in your industry using the latest Small business benchmarks.

The ATO app can automatically send usage data to help improve the app. The data we collect doesn’t identify you and you can choose to turn this off at any time in your app’s settings.

GPS can be used to record trips in myDeductions. Continued use of GPS running in the background can dramatically decrease battery life.

Find out more at www.ato.gov.au/app

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

MoMo PSB NGMTN Nigeria Communications Plc

Text Free: Call & Texting AppPinger, Inc

Chipper CashCritical Ideas, Inc.

WeverseWEVERSE COMPANY Inc.

C-RAM CIWS simulatorAnti Air Gun, Air Defense Game

Freestyle Motocross Skill 3DTop Dirt bike Motocross 3D

Now Thats TVNow Thats TV LLC

Talkatone: Texting & CallingTalkatone, Llc

Zombeast: Zombie ShooterSurvive the Zombie Apocalypse!

JazzCash - Your Mobile AccountJazzCash